Much to the delight of our Chinese friends, we live in interesting times.

The arbitrary choice and imposition of this monetary system in the USA in 1913 and from 1971 in Europe and then gradually in numerous countries around the world, brought us to where we are today.

Bankrupt governments do stupid things. A bankrupt hegemon, on the other hand, eventually, but inevitably, must go scorched earth.

As the fiscal impasse worsens, the road to scorched earth is punctuated by social, cultural and economic events of progressively greater import. Things appear plausible at the outset but in time, become variously ever more silly, egregious till they become down right threatening to the well being of the many.

In the the annals of “plausible” we note here Social Security as a typical example. A noble concept to be sure but a stratagem that, in the way it was designed, had purely fiscal motives to enable the runaway growth of the state.

Social Security was designed to take money out of the hands of Labor in order to place it in the hands of Capital to be “managed” so as to provide for the needs of labor in their old age.

Crucially, government placed restrictions on what Capital could do with this money. Namely, government decreed that 70% of funds should be invested in government securities and 20% in money market funds. Only 10% would be allowed to be invested in the stock market.

See what they did there?

No? You don’t see it? Don’t take it too hard. Neither did the press at the time nor, indeed, did any of the politicians; neither at the time nor since apparently.

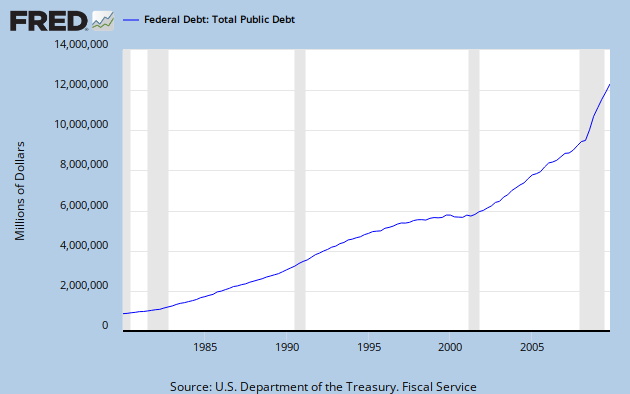

Premising that, whether kingdoms, empires or republics, there is no government in history that has not gone bankrupt, ever, someone should have had the curiosity to wonder why 70% of pension fund moneys should be invested in government securities. Particularly when a debt based monetary system can only result in the bankruptcy of the state.

In a debt based monetary system, bankruptcy is the only possible outcome. The only variable is time. Believing anything else would be to believe that we have discovered perpetual motion.

Predictably, for just over 10 years till the early 80s, the pension fund boondoggle appeared to be plausible.

And so, as subsequent incumbent governments of the right and the left ventured ever deeper into stupid territory however, debts expanded inexorably as, indeed, did debt service. By the early 80s it was clear that although great for pension funds, interest rates at 15% imposed too much of a constrain on the ability of governments to squander public funds.

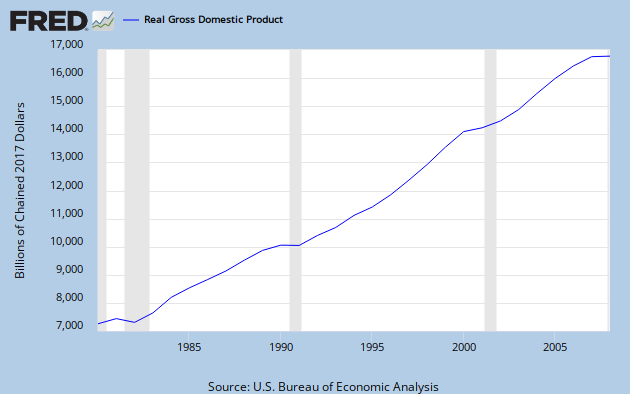

So what do you do? The nature of politics requires politicians to double down. So it was that, gradually, the mantra became that low interest rates stimulate economic growth.

And so, from the mid 80s till today, the bastion of freedom, democracy and civilization that is the West embarked on a period of interest rate manipulation culminating in the late 2010s in ZIRP or even, in some cases, Negative Interest Rates Policy.

One predictable outcome, of course, was the bankruptcy of pension funds to the extend that today even raising the pensionable age to 75 will not save the funds. It is way too late. That ship has sailed.

Along the way, staying in office required increasingly stupid stratagems that variously divested people somewhere of the ability to make a living and, more often than not, murdered people; initially at least, in foreign countries.

In a debt based fiat monetary system, the journey to bankruptcy can be postponed by subsuming the economies and monetary systems of other countries. The Marshall Plan and the abrogation of Bretton Woods were the two cases of reference in the past century.

(Speaking of the abrogation of Bretton Woods, I note here a similar parallel to what happened exactly 50 years later, with the Covid emergency. In both instances, global governments unexpectedly adopted the same stupid policies without debate or justification. That is a bit of a strange coincidence.)

Soon enough however, staying in office requires some radical stratagems and murdering nameless brown people overseas no longer suffices. The hegemon now requires the sacrifice of its own people.

Which, as luck would have it, is indeed fortuitous seeing that there is a small but rather consequential group of rather well heeled individuals who believe the world is overpopulated. Too, it is doubly fortuitous that members of this exclusive club should be individuals that are in positions of influence.

OK! I had set out to write about something completely different and have been side tracked.

The inevitable truth is that, yes, there is a group of individuals that intends to subjugate society and murder and divest the many for their own benefit. Anyone involved in politics, government or any of the para-governmental institutions like the UN are either complicit or oblivious. I have personally met both and I am not sure which of the two is more dangerous to the well being of the people of earth.

I have come to lean on the side that holds that the ones that are oblivious are more dangerous by far because they act in “good faith”. They truly believe in the righteousness of the cause.

Bankrupt governments do stupid things. Individuals animating governments and all the institutions that feed from it, cannot be expected to voluntarily do what is need in order to ameliorate the fiscal situation. Quite the contrary. They will decry the lack of funds to justify their own existence to the point of precipitating crisis.

And so it is that sooner rather than later, governments and the regulatory apparatus that has been erected around it must inevitably resort to coercion in order to save their own skin.

Enter the security apparatus. The rise of the Praetorians is inversely proportional to the fiscal health of the hegemon. The stage we are at today in 2024 brings us a political class that is fully compromised and in the grip of the security apparatus and private money.

When in June 2016 in a live television interview Joachim Gauck, former president of Germany, told you: “The elites are not the problem. The people are the problem”, you know you should have begun to wonder whether something was not right.

When the Inspector General reports on Iraq and then Afghanistan told you that hundreds of $Billions were unaccounted for year in and year out, you should have known something was not right.

When the yearly UNODC report told you that acreage under cultivation for opium in Afghanistan went from 2000ha in the year 2003 to 360’0000ha in 2016, by Jove, you knew something was not right.

When US Attorney General Loretta Lynch declared that she intended to prosecute climate change “deniers”, you should have begun to wonder where this was all going.

When in 2011 the EU told you verbatim that: “As Irish voters headed for the polling booths on Friday, the European Commission bluntly declared that the terms of the EU-IMF bailout “must be applied” whatever the will of Ireland’s people or regardless of any change of government. “It is not even take it or leave it. It’s done. Ireland’s only role in this now is to implement the programme agreed with the EU, IMF and European Central Bank. Irish voters are not a party in this process, whatever they have been told,” said the diplomat.” (The Telegraph, 26 February 2011, 8:30pm) – you should have known something was not quite right.

When you were told that an aircraft had crashed into the pentagon and all debris, down to all the bolts, had vaporized in the explosion, you should have had a bunch of questions you wanted to ask.

When the BBC anchor positioned in front of a panoramic window told you, during a live broadcast, that Building 7 had collapsed when, in fact, Building 7 was clearly visible through the window behind her and would not collapse for a further 20 minutes, you, by then, should have known something was not right.

When prince Philip, king Charles, Bill Gates, Jane Goodall, Klaus Schwab, Yuval Harari and a constellation of other personalities and celebrities try to convince you that the world is overpopulated and are collaborating to put in place a framework to tell you what to do and what to eat – you know something is not right. As a corollary to this thought, if overpopulation is indeed an existential threat, why entrust Bill Gates, the poster child of PPP, with vaccinating the entire population to save it from certain death?

When the authorities first threatened your job and then tried to cajole you with money and failed and immediately thereupon enlisted celebrities, social media and the press to browbeat you and threaten you with exclusion from society if you refused the vaccine, you should have been damn sure something was not right. And when the millions of individuals that did not take the vaccine, did not die, you should have had no doubts you were being lied to.

When there are attempts at legalizing the irreversible mutilation of pre-teens, regardless of where you stand on the political spectrum, surely you must realize that something is not right.

The only thing you may have not known is: why?

And the answer is as sad and pedestrian as the world. Money and power. Specifically, the lack of money to carry on as before.

Bankrupt governments do stupid things and will do anything rather than doing the right thing. That includes murder.

If you have any doubts that governments have in the past and currently contemplate murdering their own people, you do not know history. Just off the top of my head I will ask you to look up the following: the Lusitania incident, operation Northwoods, the Gulf of Tonkin incident, weapons of mass destruction…. go on… I’ll wait….