Everywhere I go, people come to me and sort of taunt me. My views are black on white so I can be taken to task anytime now or in the future and you guys do. I am considered a doomer with an incorrigible penchant for the dramatic without any apparent just cause.

So it is on this sunny Friday morning that as I bop to the groove of The New Mastersounds playing “Make me proud“, I thought I should. So here it goes.

Has government action, legal or not, avoided catastrophe?

To answer this question, lets go back to the charts that are thoughtfully produced by our trusty Federal Reserve of St Louis

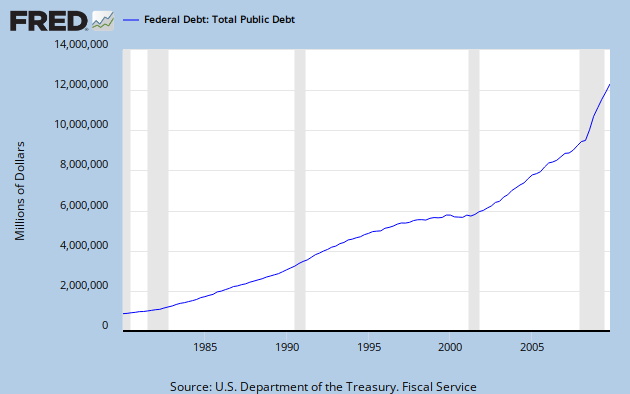

Once again, from 1980 till today, government spending looks like this:

–

–

So, government debt went from about US$1Trillion to about US$12Trillion

And what did we get for all this munificence?

–

–

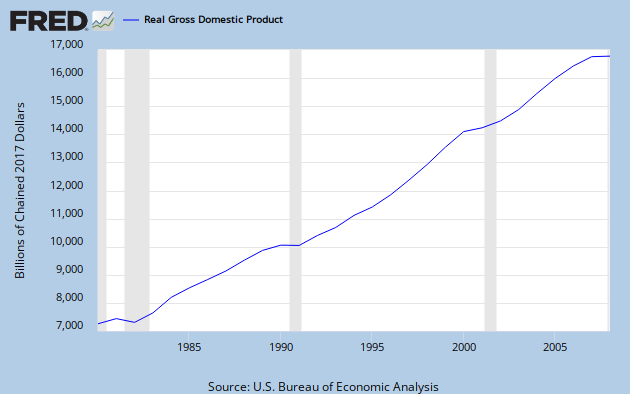

There you have it. Whilst GDP progressed by about 100% since 1980, government debt progressed by about 1200%. Of course, these figures do not take into account neither consumer nor corporate debt. If I did, the picture would look even more dramatic than it already does. Essentially, in order to expand GDP by a meager 100% in thirty years of ostensible social and economic development, we have embarked on a binge of debt of galactic proportions that has no precedent in the history of man ever.

So the question is; have Western governments today avoided catastrophe by bravely carrying on doing what they have done for the past thirty years only on a grander and more daring scale?

If so, at what cost?

Everyone that taunts me points at the gains in the stock market and exclaims: “See!? You were wrong. We have recovered and all is well again.”

I am not so sure of course. If we have avoided catastrophe now, it won’t be for long. It can’t be for long.

Essentially, if we have avoided catastrophe, this truly would be a most undesirable case of the end justifying the means. The inescapable conclusion would be that deficits and debt don’t matter. In that case, why not have government borrow unlimited amounts of money and pay a salary to every single citizen for ever?

Just in the past thirty years, private, corporate and government debt has expanded by well in excess of 1000% (somewhere in the region of 1500% to be exact) and yet, GDP only really pottered about in the neighborhood of 100%

If you think this crisis was only a near miss with doom but all is now well once again, I can guarantee that the next crisis will whack us all upside the head hard. And considering the amount of debt that has been piled up just in the past 12 months with unorthodox (and untested) forms of debt that don’t show up in the above charts, I can guarantee that the next dip will be a doozie.

Our governments truly have made a Faustian pact with the monetary authorities.

Bullion still looking awfully good from where I’m standing.

Tags: debt, economic recovery, gdp

This entry was posted on January 15, 2010 at 8:08 am and is filed under Current events: economics & politics. You can follow any responses to this entry through the RSS 2.0 feed.

You can leave a response, or trackback from your own site.

January 16, 2010 at 5:07 am |

the concern here is not only the USA but the reserve currency the US$. so even if there should be a country where the fiscal situation might not be dramatic, the fact that they are members of the global monetary system based on the US$ will devastate state finances.

part of me has to believe that the decision to bailout the banks was unwittingly misguided. i have to believe that most of our politicians genuinely think that the fractional reserve system is not impaired and that the money will enter the economy and spur inflation once again.

of course the fact that it hasn’t and that they are planning to do even more of the same hoping for a different result may point to a degree of delusion that at some point must border on incompetence if not criminal negligence.

January 16, 2010 at 2:41 am |

The truth is obvious to anyone of average intelligence that is willing to spend even a little bit of time to learn and to be honest with themselves. Those who don’t see what is coming are either (1) stupid (2) unbelievably lazy or (3) in denial. This last group is the most dangerous because many of these people are in positions of power. The ability to suppress the truth when it is painful is an extremely powerful human trait that should not be underestimated.

It’s real simple. The US economy has been struggling to keep pace with the rest of the world for over 30 years. To maintain the same standards of living, the US has been forced to pile on debt. The debt payments are now coming due and the US simply does not have the earnings power to pay it off.

The banks failed so the federal government bailed them out and will continue to bail them out. The states are failing so the federal government will bail them out next. The bailouts will continue until they can’t. From there, it’s only a matter of time before the federal government fails. Where we go from there is then up for debate. World wars? Global currency? Global depression? Dunno but it will not be fun.

When someone scoffs at the above, just ask them to give you one realistic scenario where things do not unfold as described.